No matter how painful they may be, interest rates appear likely to keep rising as long as the RBA has to wrestle with higher consumer spending and inflation.

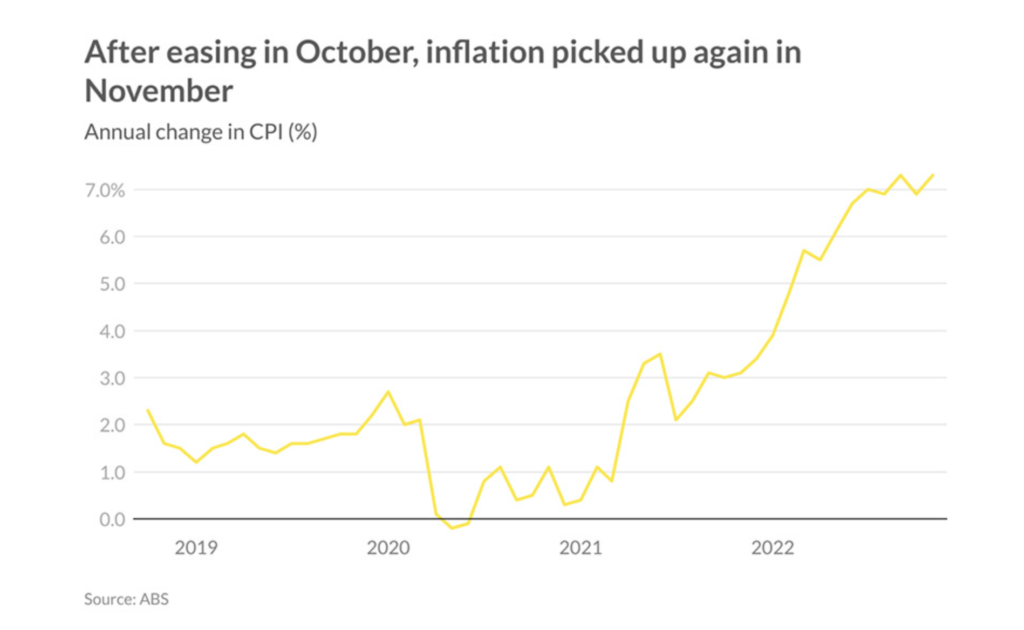

With inflation again above 7 per cent, RBA Governor Philip Lowe may have little choice but to raise interest rates again.

There is no longer a monthly Reserve Bank of Australia meeting that goes by that doesn’t stress that the dire need to curtail inflation through higher interest rates. Nor is there any shortage of real estate professionals or stressed mortgagees responding that enough is enough and the rates rises have taken effect and must stop.

But regardless of the pain felt by homeowners trying to meet mortgage repayments, recent buyers staring into the abyss of negative equity, or property prices falling at the fastest pace in memory, any hope that rate rises might abate soon appears slim.

Australians, however stretched they claim to be, continue to spend like the proverbial sailor who’s had one drink too many.

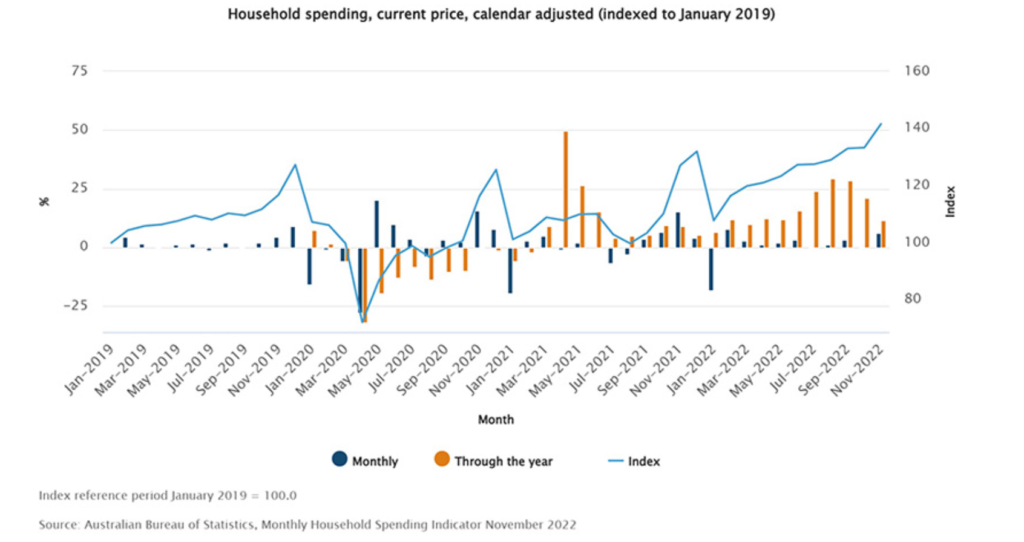

The latest Australian Bureau of Statistics (ABS) data indicates that household spending continued to rise in November 2022, increasing by 11.4 per cent compared to the same time last year.

As a result, the Consumer Price Index (CPI) rose from 6.9 to 7.3 per cent, no doubt setting off alarm bells in the RBA’s headquarters.

Cruelly for those struggling with cost of living demands and covering their basic essentials, housing is the main contributor to the annual increase inflation.

High labour and material costs contributed to the annual rise in new dwelling prices (+17.9 per cent) although, the rate of price growth for new dwellings has eased compared to the 20.4 per cent annual rise seen in October.

The most significant contributors to the annual rise in November were housing (+9.6 per cent), food and non-alcoholic beverages (+9.4 per cent), transport (+9.0 per cent), furniture, household equipment and services (+8.4 per cent) and recreation and culture (+5.8 per cent).

Whichever way it is broken down, RBA Governor Philip Lowe, if he remains as true to his word as he has throughout the current cycle of rate hikes, will have little choice but to hit borrowers yet again.

Mr Lowe said the interest rate would go up another 0.25 per cent to 3.1 per cent – the highest level since 2012 and the big four banks have forecast another 25 basis points increase at the next RBA meeting in February.

While inflation remains high, there are clear signs that the Australian economy is slowing on the back of two releases of economic data this week.

Job vacancies are now starting to decline with 23,000 fewer jobs being advertised in November 2022 compared to August. The number of jobs available remains particularly high but interest rate increases are clearly starting to slow some industries.

The main driver of high inflation continues to be housing, and while construction cost increases are starting to slow, high advertised rents are now starting to hit sitting rents.

In addition to this, food costs are rising due to flooding and fuel cost increases continue to be a problem.

For now, any mortgage or rental stress that people may be feeling is yet to flow through to spending on goods and services, a situation that is likely to change this year.

Eleanor Creagh, Senior Economist at PropTrack, said buyers would retain the upper hand in the property market in 2023, as interest rate pressure continued to weigh on property values nationally.

“With market conditions cooling and more choice, buyers are regaining the upper hand in negotiations, properties are staying on the market for longer, with buyers having less pressure to move so quick,” she said.

“It will take time for higher interest rates to fully affect prices, so they are likely to continue to fall as interest rates continue to rise.”

But she added that the downward pressure from rate rises will be countered to a degree by positive demand effects that stem from tight rental markets and rental price pressures, rebounding foreign migration, stronger wages growth and, over the long run, housing supply pressures.

The case for a rates pause

Acknowledging inflation had risen, Hayden Groves, Real Estate Institute of Australia (REIA) President, said it was still time to rein in the interest rate hikes.

“While the latest inflation figure is up, it is the same as the figure for the September quarter and is below the Budget forecast of 7.75 per cent and the RBA’s forecast of 8.0 per cent, pointing to a slowing down in the rate of increase.

“While new dwelling prices rose 17.9 per cent in the year to November, the rate of price growth eased in November compared to the 20.4 per cent annual rise in October.

“Rent prices increased further this month from an annual increase of 3.5 per cent in October to 3.6 per cent in November, reflecting the continuing tight market and low vacancy rates.

“With the RBA Minutes of its December 2022 meeting showing that the Board expected a sustained decline in inflation in 2023 and the current CPI suggesting that the CPI has peaked, it is time for the RBA to ease up on its interest rate hikes at its first meeting in 2023 in February,” Mr Groves said.

The impact of rising interest rates and higher loan repayments have severely impacted all borrowers with Canstar’s analysis showing borrowers faced a 38 per cent increase in home loan repayments from May to November, adding more than $800 to repayments on a $500,000 loan over 30 years or more than $1,600 on a $1 million loan.

Australian borrowers will be eagerly, or tentatively, awaiting the outcome of the next RBA interest rates announcement on 7 February.

Author: Craig Francis, international news journalist and editor